Finexora:

Finexora: Daily AI Perspectives on Market Trends

Sign up now

Sign up now

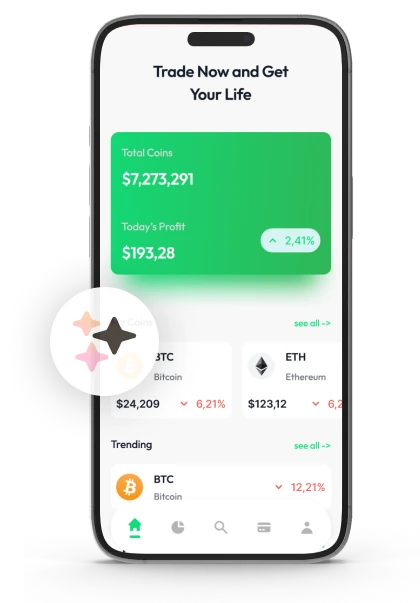

Market volatility is organized into clarity through Finexora. Expansive trend shifts and momentary pauses are interpreted as a single structural sequence, preserving rhythm and analytical balance. Advanced filtering mechanisms isolate impactful behavior while removing transient distractions.

Intelligent evaluation identifies pressure zones and participation dynamics, translating raw movement into directional context. This approach maintains analytical stability when conditions shift rapidly, supporting dependable market interpretation.

Through ongoing data assimilation and adaptive intelligence mapping, disconnected signals are synthesized into cohesive analytical outputs. Finexora delivers AI based market analysis only, operates independently of trade execution, and recognizes the elevated risk and volatility inherent to cryptocurrency markets.

Finexora absorbs real time valuation shifts into dynamic processing layers that adjust instantly as signals emerge. Structured verification governs each observation, sharpening control mechanisms and minimizing impulsive interpretation. By drawing from preserved market sequences, the system grounds every evaluation in a deeper, experience driven context.

Finexora continuously observes crypto market variation through responsive analytical scrutiny. Each directional change is measured for tempo and intensity, translating movement into contextual insight that supports measured timing and balanced decision frameworks. As momentum shifts and sentiment cycles reshape direction, disciplined pattern analysis strengthens situational awareness.

Layered analytical logic within Finexora captures fast forming impulses and converts them into actionable awareness. Real time comparisons between emerging behavior and historical structures uncover early alignment shifts. Focused guidance maintains clarity and adaptive control across evolving and reactive conditions.

Finexora supports the mirroring of structured methodologies identified through shared analytical intelligence. Participants retain full autonomy, with adaptive cues guiding perspective rather than triggering execution. Supervisory systems sustain analytical discipline as integrated intelligence evaluates broader trends and issues timely insights. The platform remains autonomous, exchange independent, and performs no trade execution.

Analytical protection is fundamental to Finexora. Free from exchange connectivity and trade execution, the system relies on layered encryption, permission based access, and persistent verification routines. All data is retained within a closed, validated framework designed to uphold consistency, confidentiality, and factual integrity.

Finexora provides a neutral analytical environment that promotes awareness without prescribing decisions. Participants maintain full control as advanced tools detect fine grained reactions and evolving micro patterns. Through disciplined observation and precision tracking, developing nuances are recognized, measured, and interpreted with clarity. Cryptocurrency markets are highly volatile and losses are possible.

Within Finexora, AI driven analytics engage live activity as it unfolds. Each shift is registered in real time, allowing analytical adjustment to match prevailing conditions. When irregular behavior or pattern divergence is detected, targeted prompts sharpen focus and preserve structured evaluation across fast moving sessions and continuous global markets.

Finexora is designed to reduce impulsive interpretation by reinforcing measured, proportionate analysis. Instead of reacting to noise or speculation, tiered evaluation processes maintain coherence and analytical discipline. Multi layer computation refines dense inputs, extracts meaningful trend behavior, and establishes consistent reference structure, supporting dependable analysis across shifting market conditions. Stabilized context broadens perspective and strengthens disciplined outcome assessment.

Built on modular intelligence, Finexora responds to changing environments while enabling comparative analysis across diverse scenarios. Its internal framework links live feeds with structured reasoning to surface deeper market composition. Clean signal delivery removes distortion, ensuring uninterrupted insight and allowing steady focus through unpredictable movement.

By combining historical archives with real time observation, Finexora expands visibility into recurring volatility patterns. Extended data analysis identifies repeating characteristics, sentiment oscillations, and behavioral formations within crypto markets. This groundwork allows live evaluation to interpret rapid shifts, from controlled momentum increases to abrupt directional reversals, across continuous exposure.

Always active, Finexora sustains continuous awareness so that every significant transition is detected in real time. Automated intelligence evaluates volume flow instantly, isolating irregular participation and developing sentiment changes. Detected conditions trigger focused analysis, preserving alignment and interpretive stability across global trading cycles and periodic rebalancing phases.

To support consistent operation, Finexora provides structured procedural assistance for resolving technical challenges efficiently. Guided navigation converts issues into traceable solutions. A streamlined interface and adaptive controls allow both new and experienced users to maintain oversight without interruption. Analytical continuity is preserved, updates remain contextual, and system control stays intact. The platform operates independently of exchanges and does not execute trades, maintaining transparency and reinforced security standards.

Finexora maintains a persistent monitoring network that tracks rhythm changes, evolving trends, and shifting market narratives. Dense information is distilled into concise insight at moments of peak importance. Intelligent models measure intensity, surface hidden movement, and isolate pressure areas, allowing users to remain composed without chasing every fluctuation, even during turbulent sessions, tightening liquidity, or wide market transitions where signal clarity is often obscured.

Free from execution and exchange connectivity, Finexora functions solely as an analytical assistant. Users retain full control over decisions, while the system reveals turning zones, strategic alignments, and contextual timing across calm and accelerated conditions. Focus remains intentional, interpretation measured, and conclusions supported by verified data and balanced review.

Every interaction within Finexora is secured through layered encryption and multiple verification stages. The platform emphasizes clean structure and accessible design, uniting clarity with responsive utility. Flexible instruments, intuitive navigation, and stable system architecture ensure consistent confidence and operational calm during periods of market pressure.

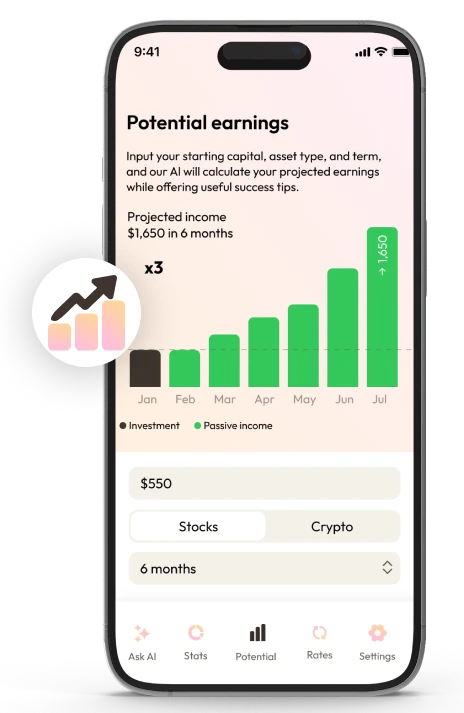

Momentum emerges from disciplined consistency. Finexora applies evolving matrices, structured feeds, and continuous refinement cycles to maintain clear evaluation across fluctuating intervals and expanded perspectives. Stored sequences paired with responsive visualization uncover recurring tendencies and surface areas where performance may weaken.

Automated detection within Finexora captures meaningful changes as they occur. Focused prompts help compare direction, evaluate progress, and apply intentional adjustments that stay aligned with shifting goals, while preserving flexibility as sentiment evolves and patterns reset.

Whether navigating short term rhythm or long term pacing, structure remains essential. Fast moving conditions require constant adjustment, while extended cycles call for broader contextual awareness. Finexora connects both ends of this spectrum, delivering analytical signals that allow tactics to align naturally with individual time horizons and directional goals.

Momentum often builds within focused participation zones before wider recognition occurs. By combining expansion and contraction dynamics with rotational analysis, Finexora reveals where strength is consolidating and where reduction is emerging. This layered insight improves anticipation of directional change and supports more accurate evaluation timing as leadership shifts across sectors and global markets.

Position control depends on clear rules, time based intervals, and measurable boundaries tied to confirmed context. Objective criteria replace impulse driven assumptions. Finexora organizes this discipline using scenario planning, recurring checkpoints, and scheduled reviews, ensuring each modification follows deliberate logic and directional consistency is maintained through accelerating or compressing conditions.

By identifying regimes and synthesizing collective intelligence, Finexora differentiates stable structures from temporary noise. It assesses participation strength, correlation movement, and behavioral signals that often precede large transitions. Timely prompts encourage review, allowing reference points and monitoring lists to adapt quickly. Each assessment records intent, updates benchmarks, strengthens discipline, and preserves situational clarity, supporting smoother decision flow through ongoing rotations.

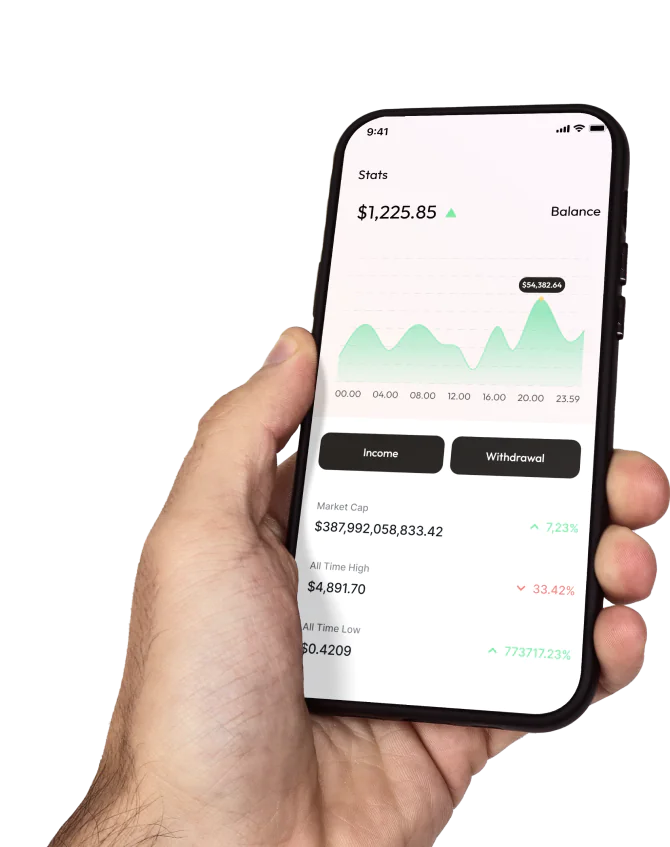

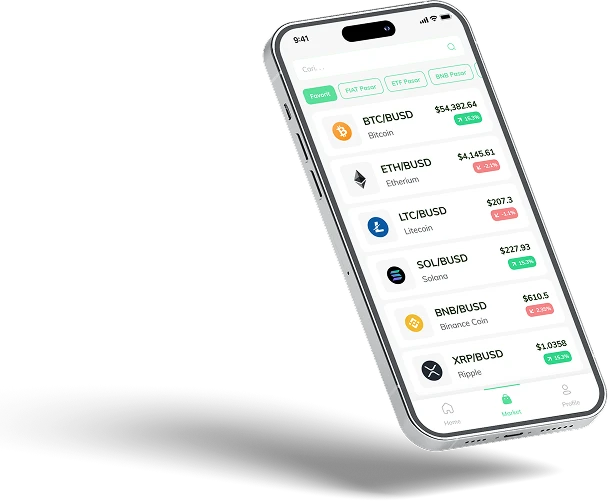

Finexora visualizes market behavior through precision tools such as range maps, momentum metrics, and cycle indicators. Together, these instruments reveal pace of movement, reaction levels, and directional pressure, strengthening awareness and improving short term analytical clarity.

Range analysis highlights pressure thresholds, momentum readings track force and trend progression, while oscillation monitors expose weakening impulse. Automated refinement sharpens these signals, ensuring interpretation is guided by verifiable structure instead of surface volatility.

Through intentional separation of signals, Finexora removes overlap and preserves analytical distinction. Repeated evaluations, layered validation, and organized feedback loops clarify sequence and timing. The result is a disciplined rhythm that replaces hesitation with factual alignment and sustained contextual reliability.

Perception often moves ahead of proof. Finexora compresses social conversation, published insight, and commentary into focused sentiment intelligence that filters noise and highlights what truly matters.

The scanning hub navigates vast data streams to detect emotional turning points early. Growing optimism may indicate momentum building, while a softening narrative can signal fading participation across liquidity shifts, session overlap, and cyclical transitions where sentiment changes before price reacts.

This layer of interpretation enhances structural analysis. Tracking behavioral tone through Finexora keeps strategies connected to the market’s real tempo. By weighing differences across sources, locating balance zones, and converting narrative flow into usable awareness, the system minimizes speculation and preserves clarity through uncertain periods.

Large scale events, fiscal revisions, rate changes, or employment reports, often reshape the direction of crypto markets. Using AI powered macro intelligence, Finexora examines how these external signals influence asset behavior, especially when policy pressure redirects attention toward decentralized assets, institutional repositioning, and fragmented sentiment across global systems.

Policy evolution rarely ends with an initial response. By aligning archived market behavior with real time momentum, Finexora develops predictive perspectives that help maintain composure during volatility, sudden reversals, and extended periods of uncertainty across digital market cycles.

Market movement frequently follows subtle, hidden rhythms. Within Finexora, comprehensive analytics merge with live evaluation to align asset trends with technical patterns, producing structured intervals for focused study, strategic configuration, and precise decision execution amid changing liquidity and evolving conditions.

Its dynamic framework identifies cyclical sequences, repeated structural formations, and wave like transitions. These discoveries illuminate timing relationships, showing how sequential flow influences performance across volatile swings, reversals, and intricate phases where perspective ensures stability and measured progression.

Rather than leaving performance to luck, layered diversification distributes exposure to limit the impact of any single event. With AI powered correlation mapping, Finexora demonstrates how portfolios behave under pressure, revealing patterns of alignment and separation across assets as tension unfolds.

Finexora removes analytical noise to highlight directional tendencies before they expand. Sudden accelerations, compressions, and subtle stress signals are detected early, allowing participants to act strategically instead of chasing reactive momentum.

Momentum often develops quietly before becoming visible. Latent energy accumulates in subtle pressure changes beneath the surface, which can be missed without careful monitoring. Finexora distinguishes genuine movement from background fluctuation, ensuring focus remains on confirmed market dynamics.

Through AI driven evaluation, Finexora interprets rapid spikes, concealed retreats, and unpredictable patterns with clarity. Seemingly chaotic activity is structured into actionable context, transforming uncertainty into informed insight and steady observation.

Finexora combines high speed data mapping with structured frameworks to deliver clear operational insight in turbulent market environments. Incoming sequences are filtered, processed, and distilled, revealing changes in velocity, recurring patterns, and underlying system balance.

Calibrated to participant inputs, Finexora evolves with shifting conditions. Updates maintain structure and analytical rigor, offering reliable reference and measured direction even as volatility and uncertainty persist.

Through intelligent learning models, Finexora transforms massive datasets into digestible, structured layers. It identifies subtle market behaviors buried in noisy or distorted information, isolating what matters most. The result is simplified, precise analysis that flows naturally across readable, actionable segments.

Absolutely. Beginners and seasoned analysts alike gain from its adaptive design, which turns dense, complex data into clear, manageable insights. Each visual and analytical element is structured to maintain understanding and consistent orientation, regardless of skill level.

Operating independently of exchanges, Finexora performs no trade execution. This ensures evaluations remain unbiased and fully transparent. Every analytical step is designed to highlight real time context and support informed decision making, rather than dictate outcomes, keeping users focused on structured, reasoned insight.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

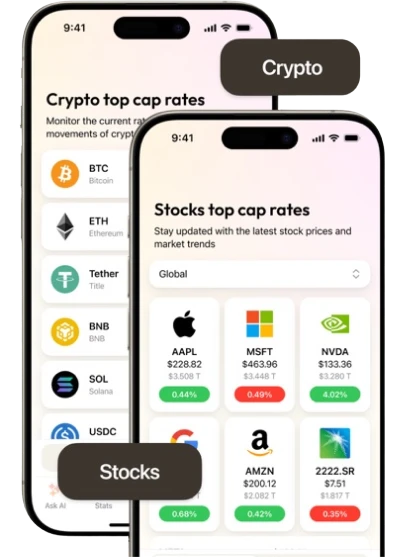

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |